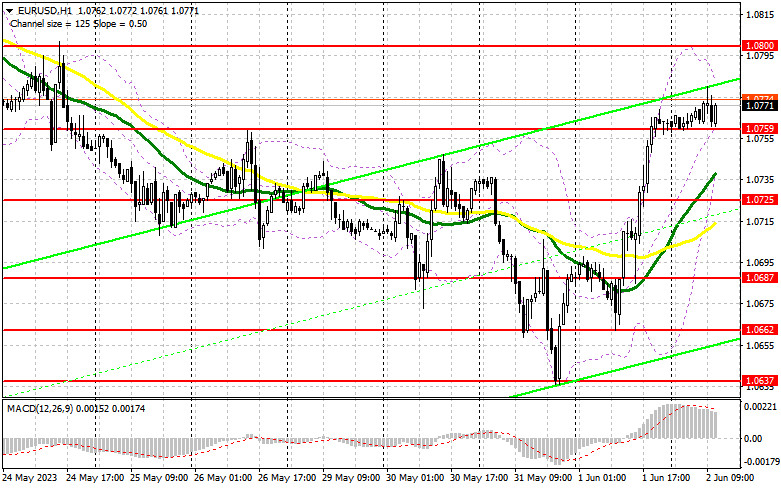

In my morning forecast, I mentioned the level of 1.0800 and recommended making trading decisions based on it. Let's look at the 5-minute chart and analyze what happened there. There was no active trading in the first half of the day, and the pair continued to hover around 1.0763, preventing entry into the market. A surge in volatility will likely occur during the American session, for which the technical picture has been slightly revised.

To open long positions on EUR/USD:

Only weak reports on the US unemployment rate and non-farm employment change in May will allow euro buyers to increase their long positions. An interesting report will also be on the change in average hourly earnings, which will affect inflation in the US. If the data exceeds economists' forecasts, I expect a decrease in EUR/USD. In such a case, I will look for long positions near the nearest support level at 1.0725, where the moving averages are located, playing on the bullish side.

A false breakout formation will confirm the presence of buyers pushing the euro up, providing an opportunity to enter long positions with the target of growth towards the 1.0759 level, where trading is currently taking place. Sustained trading above this range or a breakthrough and retest from top to bottom after a decline will strengthen demand for the euro, forming an additional entry point for increasing long positions with a target of a new high around 1.0800. The ultimate target remains the 1.0833 area, where I will take profit. In the case of a decline in EUR/USD and a lack of buyers at 1.0759 and 1.0725, which cannot be ruled out with good labor market figures in the US, a bearish return can be expected. Therefore, only a false breakout formation around the 1.0687 minimum will signal to buy the euro. I will open long positions immediately on the rebound from 1.0662, with a 30-35 point upward correction target within the day.

To open short positions on EUR/USD:

Bears are not active right now, as there is no real reason to sell risk assets. Good statistics on the US labor market are unlikely to convince American policymakers to abandon the pause in the rate hike cycle but may lead to a downward correction in the pair. However, as I described in the morning strategy, I will only act on a rise from the nearest resistance at 1.0800.

A false breakout at this level will signal a sell-off that can push the pair back toward the 1.0759 level, the new support formed during the first half of the day. Sustained trading below this range and a reverse test from bottom to top will lead directly to 1.0725, where the moving averages are playing on the bullish side. The ultimate target will be the 1.0687 area, where I will take profit. In the case of upward movement in EUR/USD during the American session and a lack of bears at 1.0800, we can expect the continuation of the pair's rise. In such a case, I will postpone short positions until the 1.0833 level. Selling is also possible there, but only after an unsuccessful consolidation. I will open short positions immediately on the rebound from the 1.0870 high, with a 30-35 point downward correction target.

In the Commitment of Traders (COT) report for May 23rd, there was a decrease in long positions and an increase in short positions. The decline in the euro continued as the situation with the government debt had not yet been resolved, and the risks of a more severe recession in the US had not disappeared. Even after the news of reaching an agreement and avoiding a US default, the dollar remained in demand. The latest inflation data confirmed the need for further rate hikes by the Federal Reserve, so investors no longer expect a summer lull. The COT report indicates that non-commercial long positions decreased by 8,666 to 250,070, while non-commercial short positions jumped by 4,687 to 76,334. The overall non-commercial net position increased to 185,045 from 187,089 during the week. The weekly closing price decreased to 1.0793 from 1.0889.

Indicator signals:

Moving Averages

Trading is conducted above the 30-day and 50-day moving averages, indicating a likelihood of an upward correction.

Note: The author considers the period and prices of the moving averages on the H1 hourly chart, which differs from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands

In case of an upward movement, the upper boundary of the indicator around 1.0780 will act as resistance.

Description of Indicators

• Moving Average (determines the current trend by smoothing out volatility and noise). Period 50. Marked in yellow on the chart.

• Moving Average (determines the current trend by smoothing out volatility and noise). Period 30. Marked in green on the chart.

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20.

• Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The net non-commercial position is the difference between non-commercial traders' short and long positions.